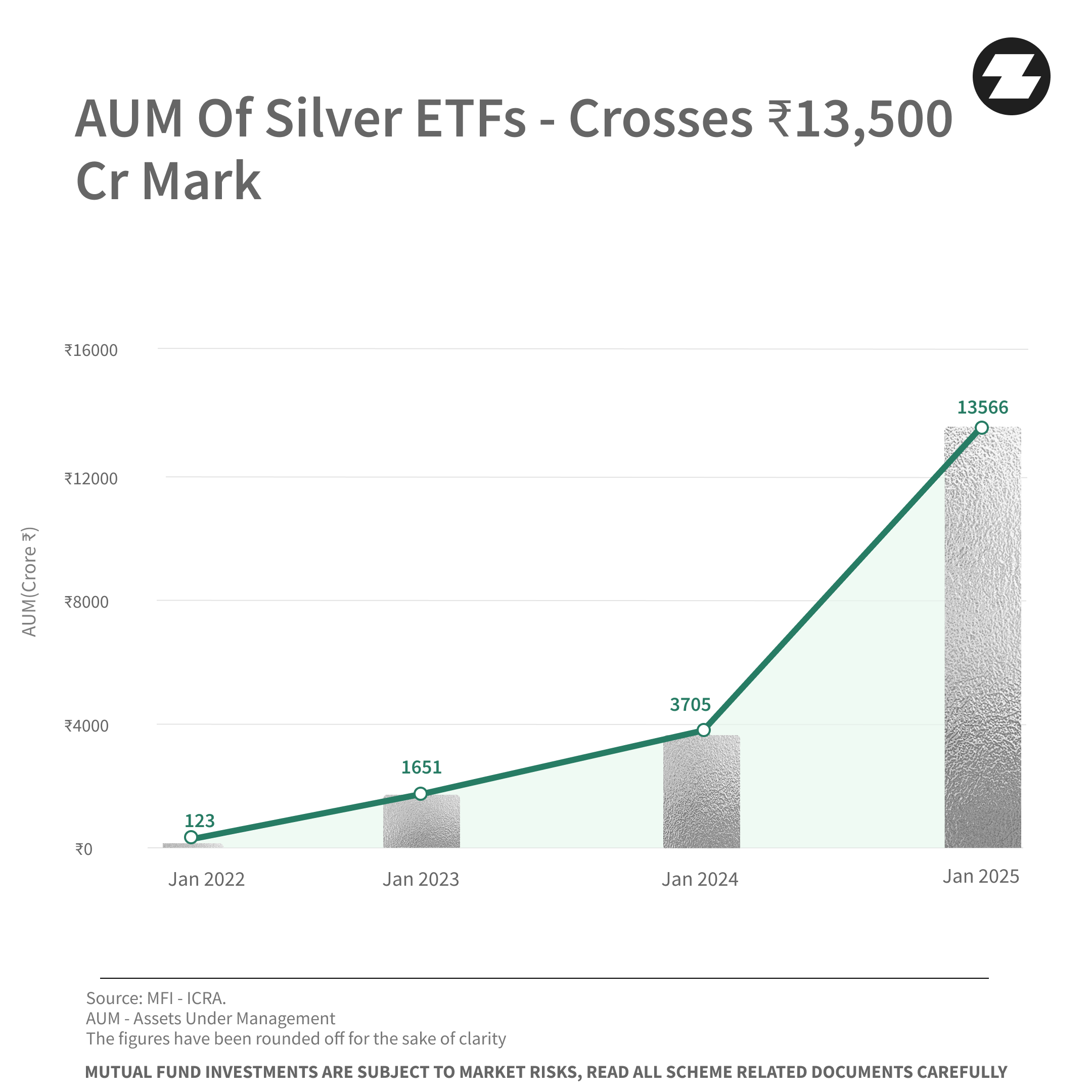

AUM of Silver ETFs crosses ₹13,500 Crs within 3 years

In November 2021, SEBI (Securities and Exchange Board of India) allowed Asset Management companies to launch silver ETFs (Exchange-Traded Funds)[1]. Since then, silver ETFs have seen massive growth (as shown in below graph) in AUM, crossing the ₹13,500 cr mark as of Jan 2025.[2] There are 12 Silver ETFs with more than 6 Lakh investor folios across them as of Jan 2025.

Silver Demand has far surpassed the supply

[3] Since 2021, the demand for silver has outpaced its supply. This versatile metal is both a valuable commodity and a crucial component in various industries, including solar energy and automotive manufacturing. Silver's diverse applications, from industrial uses to jewelry, digital photography and investment also contribute to its demand.

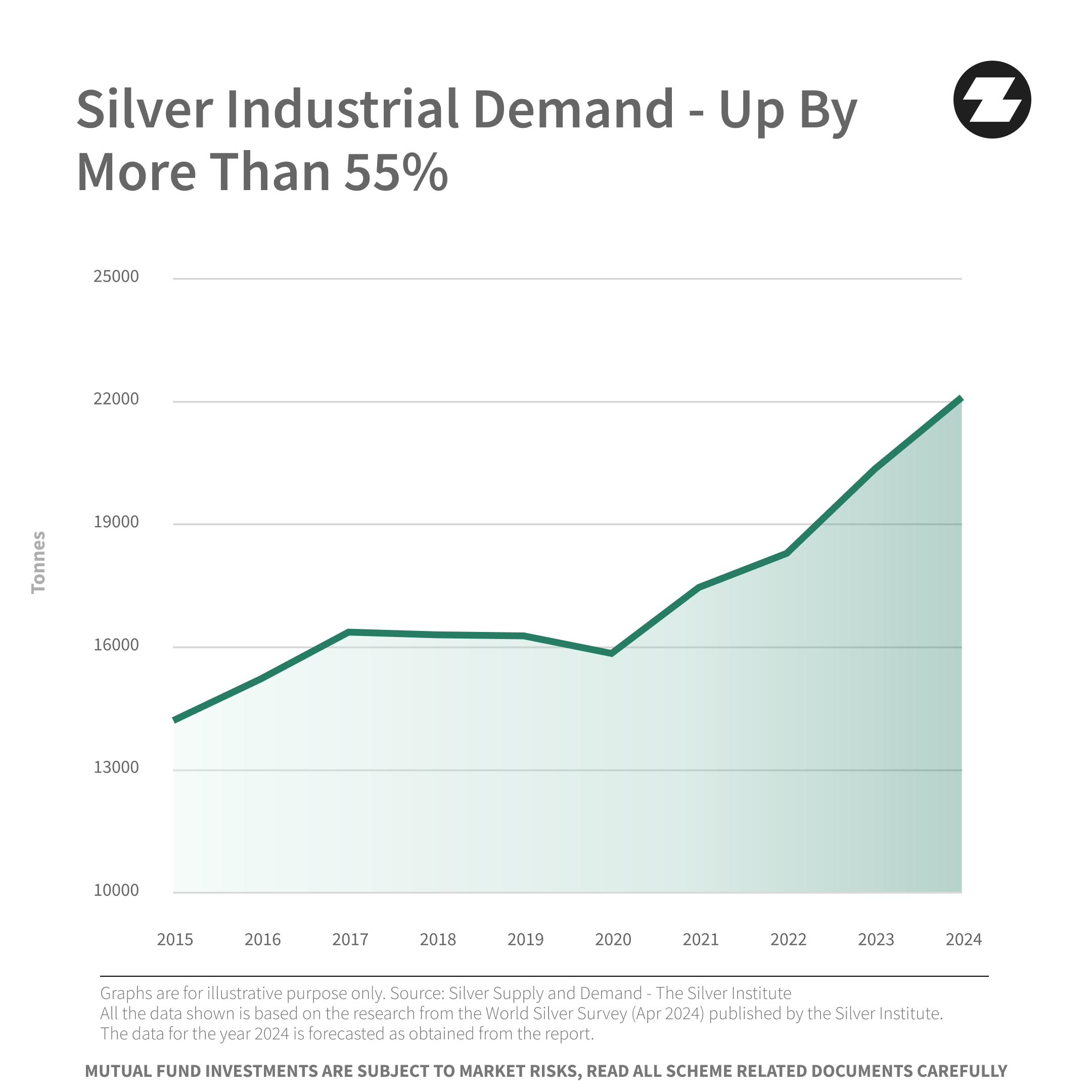

Industrial Demand for Silver has increased by more than 55%

According to the estimates by ‘The Silver Institute’, the overall industrial demand for Silver has increased by more than 55% driven by its applications across various industries, including automotive, technology, pharmaceuticals, and solar energy. Silver is also used in manufacturing and industrial fabrication since it does not corrode and has good thermal properties.

In a three year period, from (Jan 2022- Jan 2025), the AUM of Silver ETFs have crossed ₹13,500 Crs! Also, as of Jan 2025, with over 6 lakh investor folios, it's clear that Indian investors are taking exposure to silver. As investors seek diversification and exposure to commodities, Silver ETFs provide a simple and hassle free way to take exposure to this precious metal.

Source:

[1] - SEBI Norms for Silver ETFs

[2] - AMFI MF Industry Data - Jan 2024 to Jan 2025 as communicated by AMFI. These figures have been rounded off for the sake of clarity.

[3] - Silver Supply and Demand

Disclaimer - Please note that this article or document has been prepared on the basis of internal data/ publicly available information and other sources believed to be reliable. The information contained in this article or document is for general purposes only and not a complete disclosure of every material fact. It should not be construed as investment advice to any party in any manner. The article does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers shall be fully liable/responsible for any decision taken on the basis of this article or document.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Published on 27 March 2025