Comprehensive Guide to Investing in Gold

Gold represents a versatile investment proposition due to its dual nature as both a consumer good and an investment asset. This dual role allows it to provide effective diversification during times of financial turmoil while also benefiting from growth in jewellery and technology demand during periods of economic growth.

Brief Overview of Gold as an metal

[1] “The estimates currently available suggest that around 216,265 tonnes of gold has been mined throughout history, of which around two-thirds has been mined since 1950. And since gold is virtually indestructible, this means that almost all of this metal is still around in one form or another.

Total above-ground stock (end-2024): 216,265 tonnes

- Jewellery ~97,149t, 45%

- Bars and coins (including gold backed ETFs) ~48,634t, 22%

- Central banks ~37,755t, 17%

- Other ~32,727t, 15%

- Reserves ~54,770t*

- Resources ~132,110t*"

Why invest in Gold

Gold holds a special place as a culturally significant metal in the hearts and homes of countless Indians. It is considered a store of value, a symbol of wealth and status and a fundamental part of many rituals. Gold is often considered to act as a hedge against market volatility as it has low correlation with Equity. Thus introducing gold into your portfolio can potentially reduce overall volatility, providing a more stable path towards achieving your financial objectives.

What are the different Gold Investment Options?

Let’s understand the different types of Gold products that are available:

Physical Gold →

- Bullion bars

Bullion bars and coins could be a potential choice for investment. They are stamped with their weight, purity, and a serial number for identification purposes. - Coins & other collectibles

Gold coins and collector items, such as medals, typically hold additional worth beyond their gold content because of their design or scarcity. - Investment jewellery

Jewellery made of pure gold qualifies as an investment in many markets. Pieces are often sold by the gram, but luxury brands can hold additional value.

Digital Gold →

Digital Gold represents a digital representation of physical gold, backed by actual gold reserves. It enables investors to own gold without the need for physical possession.

Avenues to buy Digital Gold:

MMTC-PAMP’s digital gold in India bears the 24K 999.9 purity mark and is backed by stringent authenticity verification and transparent pricing. Through MMTC-PAMP’s partners one can transact in digital gold with a few clicks.

Gold ETFs, Gold Funds & similar products →

Physically-backed gold exchange-traded funds (ETFs) invest in gold bullions. Gold ETFs allow investors to gain exposure to gold as an asset class through the convenience of a modern digital investment. Investors who buy units of ETFs do not have to trade physical gold directly or manage the safekeeping of their holdings; they can buy units of an ETF as easily and quickly as they would buy equity shares of listed companies. Gold might act as a hedge against equity. Having gold along with equity may help bring down the portfolio volatility.

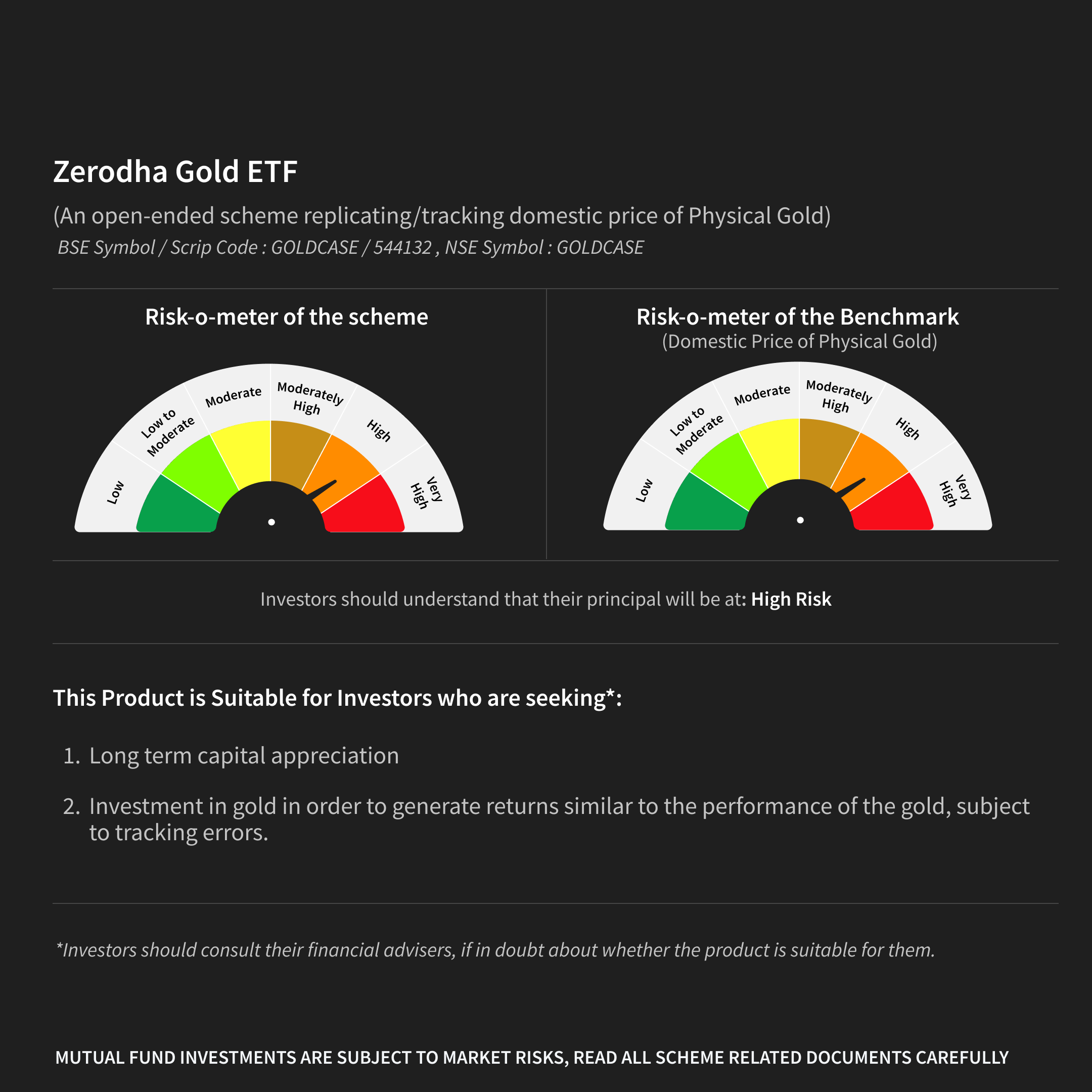

At Zerodha Fund House we offer a Gold ETF viz., Zerodha Gold ETF. You can read more about the scheme on our website here.

Sovereign Gold Bonds (SGBs) →

SGBs are government securities denominated in grams of gold. They may be regarded as substitutes for holding physical gold. Investors have to pay the issue price in cash and the bonds will be redeemed in cash on maturity. The Bond is issued by the Reserve Bank of India on behalf of the Government of India. The SGB offers a superior alternative to holding gold in physical form. The risks and costs of storage are eliminated. Investors are assured of the market value of gold at the time of maturity and periodical interest.

Comparison of Gold ETFs, SGBs & Physical Gold

Conclusion

Gold is accepted the world over. Due to its low correlation with asset classes such as equity, gold may be useful to diversify a portfolio. Hence, when used in the construction of diversified portfolios, gold potentially helps reduce overall risk to a portfolio; however, as with all investments investing in gold is not without risk. Investors are requested to carefully evaluate their financial goals and investment horizons before making any investment decisions.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully

Please note that this article or document has been prepared on the basis of internal data/ publicly available information and other sources believed to be reliable. The information contained in this article or document is for general purposes only and not a complete disclosure of every material fact. It should not be construed as investment advice to any party in any manner. The article does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers shall be fully liable/responsible for any decision taken on the basis of this article or document.

Source:

[1]: Brief over view of Gold as a Metal

Published on Dec 19 2025